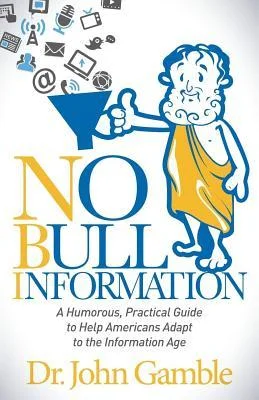

Numbers: Fighting the Fear by Dr. John Gamble

/NBI deals with different kinds of information abuse—one of the most important is numbers and statistics and the sneaky ways they are used to deceive and confuse us. I consider myself a numbers guy but also realize most of my students are not, in fact many are scared to death of numbers. This makes for angry, frustrated people. Let me work you through one example that can be helpful in dealing with the onslaught of numbers.

You see an ad on television (or on the Internet) that wants you to switch you car insurance from Gamma Insurance Company (GIC) to Kappa Mutual (KM). Let’s say you are happy with GIC—why in the world bother switching? The ad uses several things to try to get your attention:

1. First, the sales pitch if offered by one of your favorite movie actors, Sam Lockjaw. You trust Sam and he seems to believe in the product.

2. Here’s what Sam says, in a warm, sincere, convincing voice. I’ve been working with the good folks at Kappa Mutual for more than five years. They want to earn your business. Did you know that people who switched to KM from Gamma Insurance on average saved $492.

Here are the danger signals in the above:

What the hell qualifications does Sam Lockjaw to speak about automobile insurance. He does not even say he has Kappa Mutual for his own insurance. The ad does not disclose if he is getting paid for this endorsement. Take a wild guess if he is!

Let’s assume for a minute, the $492 is accurate. What does that figure not tell us. It does not reveal the percent of the savings, over what time period—a year, five years, and we are left to assume you get exactly the same policy with Gamma. It might be, but I would not bet the farm on that one.

Let’s give Mr. Lockjaw and Kappa Mutual every benefit of the doubt by assuming the figures are per year and the insurance coverage is identical. So let’s all run to Kappa Mutual’s website. Not so fast. Anytime you see a figure, a number or a statistic, you’ve got to ask how was it calculated, what is it based upon. Sam’s actor-trained voice said: “those who switched saved an average of $492.” But you need to dig deeper. Who is likely to switch to Kappa? Is it those who call or go to their website and find they can save $15 a year— of course not? Those who save a lot of money are much more likely to switch. You must know how many switched not just the average savings. Even stranger, you might get comparably high figures for those switching from Gamma to Kappa Mutual with customers switching each year in both directions.

There are a number of lessons to be learned from this simple example. Be careful to ask what qualifications someone has to pitch a product. I call this the pitcher person problem, Second look hard at the numbers to see their origin and how they are calculated. Numbers can have a mystical quality to them— we often assume they are more precise and are calculated is a wise and reasonable way. Don’t be fooled— often they are distorted— look carefully and don’t be afraid to ask questions.

About the Author

Dr. John Gamble is Distinguished Professor of Political Science and International Law at Penn State’s Behrend College in Erie and Director of Honors Programs. He is the author of approximately 100 publications and recently won Penn State’s most prestigious award for teaching, the Milton S. Eisenhower Award for Distinguished Teaching.

Dr. Gamble has stuttered all of his life. As a result, he believes words are precious and should not be taken for granted; this motivated him to write NO BULL INFORMATION. His dream for the book is that parents and grandparents will teach their children and grandchildren NBI techniques and demand clear, concise information from political leaders and service and product providers.

About the Book

In his new book, NO BULL INFORMATION, Dr. John Gamble challenges readers to confront the Information Age by abandoning simplistic thinking and taking a measured approach that requires asking questions to analyze and understand complicated issues, to identify and avoid word traps, and to effectively dissect and comprehend numbers frequently used to confuse voters and consumers.

Gamble uses humor and a wise cartoon character, Arnbi, to guide the reader through the maze of political doublespeak, expert-celebrity pitches of products, and healthcare options, among other issues.

With a focus on helping Americans to become better prepared to deal with the massive amounts of information that they face on a daily basis, NO BULL INFORMATION (NBI) instructs readers in developing “a new type of literacy.” NBI seeks to create an educated citizenry that can sift through information, identify the facts, and determine the best way to manage those facts. Gamble asserts that the super citizens who accept the challenge of NBI will make better decisions, which will lead to a reduction in financial disasters and government inefficiency.

Gamble’s cartoon sidekick, Arnbi, supports the NBI movement by offering targeted advice that summarizes many of the key principles outlined in NO BULL INFORMATION, including:

• Too bad, but “simple” is a square peg that seldom fits into the round hole that is our modern world.

• Facts are necessary but they must be put into context (PUTFiC).

• Vested interests are everywhere—recognize them.

Breaking down words and numbers is the foundation of NBI. In one section of the book, Gamble walks the reader through a basic lesson in understanding percentages and statistics. “You need to understand numbers enough not to be deceived.” In one intriguing illustration, Gamble compares the Pentagon’s budget of $700 billion to a two-liter bottle and a proposed $20 million in spending to one drop of water from an eyedropper placed in that bottle. “It is a helpful strategy for understanding large numbers that are thrown at us every day by politicians and salespeople.”

Stressing the necessity of analytical thinking, Gamble explores the use of words in “bull-laden” information and the need to guard against what the author calls “landmine words and phrases”; for example, quite frankly, my good friend, clinical studies prove, award winning, and as seen on TV.

Gamble uses guidance survey and focus cards to demonstrate how readers can practice NBI in their daily lives. The cards cover nine areas each (Survey cards: sampling, word warnings, vested interests, etc. Focus cards: infomercials, supermarkets, credit, etc.). The cards include questions that help the reader to analyze a particular situation (buying a new cell phone, for example) and offer guidance for making decisions.

“I have been a college professor for more than thirty years. I am convinced that there are serious problems with the way information is presented and understood,” Gamble says. “This affects all Americans. I am writing for and to them.”

The idea for NO BULL INFORMATION came to Gamble about ten years ago as he observed the difficulty his Penn State undergraduate students were having adjusting to the Information Age. “NBI was inspired by hundreds of students in scores of classes I have taught. It was an iterative process: a class inspired an idea for NBI that I took back to class to test before including it in the book.”

Gamble believes that people who read NO BULL INFORMATION will “gain a sense of empowerment, like a life preserver when we feel we are drowning in a mass of information.”